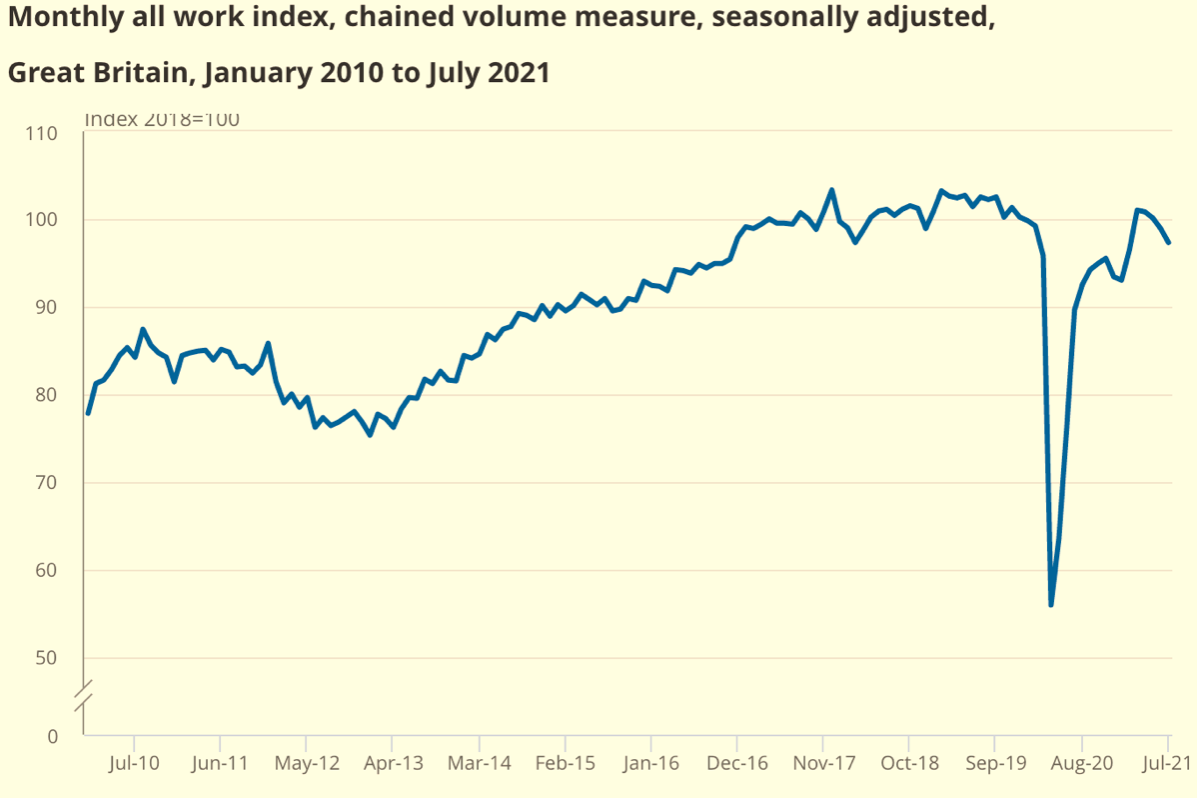

Construction output has fallen for the fourth-month running taking new work levels 3.2% below the pre-pandemic high watermark in February 2020.

Latest official figures for output show the strong construction rebound has been halted in its track by shortages of products and materials.

Growth in the volume of output was also impacted by rising prices of raw materials such as steel, concrete, timber and glass, according to the latest ONS report for July.

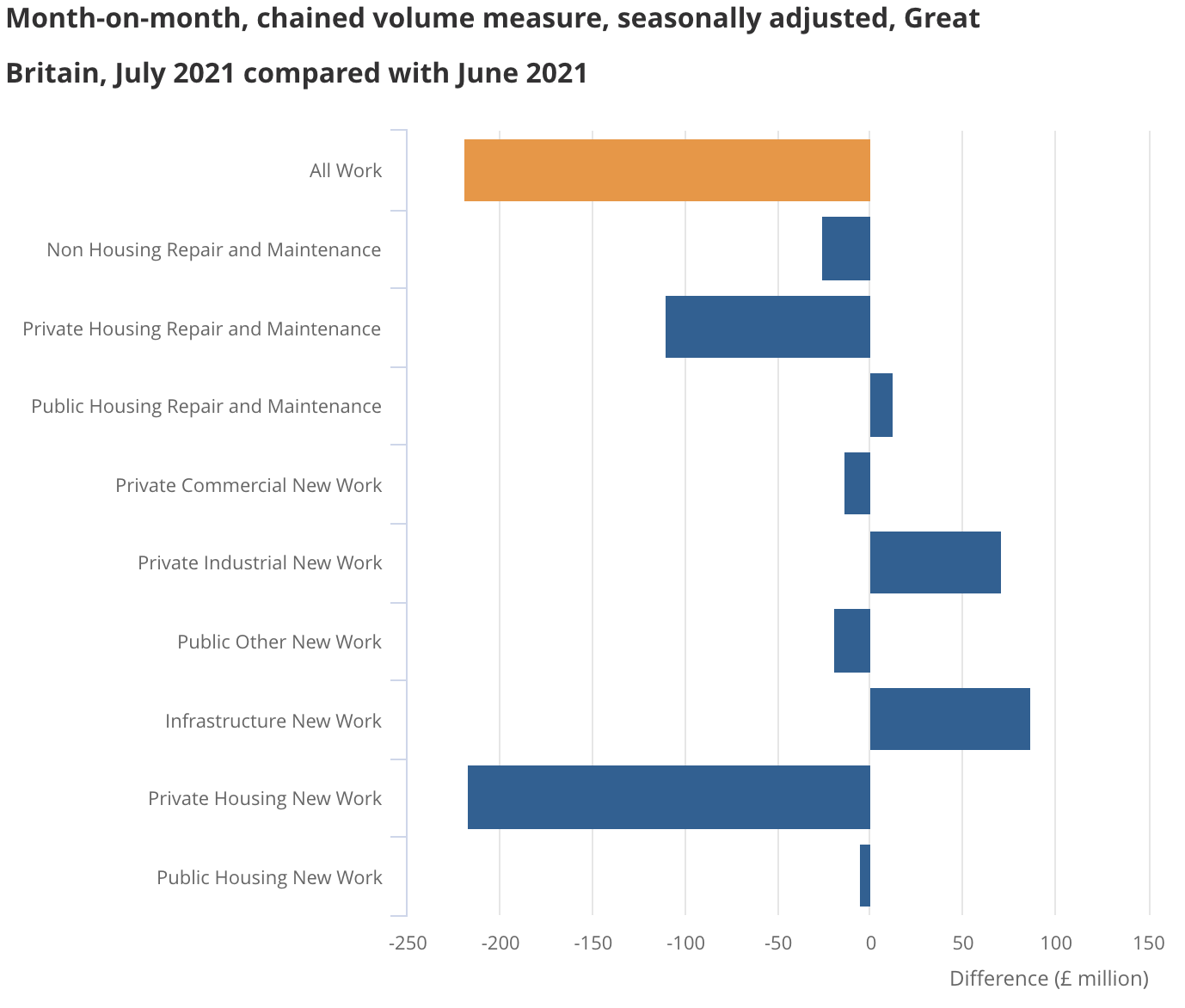

Monthly construction output fell by 1.6% in July, driven by a decline in repair and maintenance (2.4%) and a 1.1% fall in new work.

Mark Robinson, group chief executive at public procurement group Scape, said: “The construction output’s first significant contraction after several months of growth should come as no surprise given the ongoing impact of material and labour shortages in recent weeks.

“The sector has already overcome many significant challenges presented by the pandemic and managing the short-term risk caused by inflation should be the immediate priority.

“Greater collaboration between clients and contractors will remain central to this and help to ensure that an accountable and healthy environment is created from the outset.”

He added: “This also includes holding large contractors to fair payment practices, which will boost cashflow for SMEs and lessen the burden on smaller suppliers.

“Critically, these challenges mustn’t be allowed to dampen ambitions as government funding continues to be geared towards green and inclusive community regeneration as part of the recovery.

“With many important projects waiting in the pipeline, procurement will have a vital role to play.”

Private housing for both new work and repair and maintenance led the monthly decline in construction output. While the only sectors to maintain significant growth momentum were infrastructure and industrial new work.

Fraser Johns, finance director at Beard, said: “With the ONS figures putting output below pre-covid levels for the first time in months, we are seeing the real long-term impact of the pandemic start to hit home.

“The supply chain issues and price rises which stem from the slowdown in production globally, and friction at the borders due to Brexit, have knocked customer confidence and is a real concern in terms of future growth.

“As an industry we have been warning that the main threat to recovery would be supply chain issues and price rises since the start of the year. Firms will price a job now at one level only for that to rise significantly by the time they’re ordering materials.

“Contractors have to be proactive about this issue in terms of working closely with customers and consultants, ensuring they understand fully the implications of the delays and price rises, as well as maintaining strong relations with suppliers.

“By assessing the situation on a daily basis and introducing multi-step procurement processes in order to absorb the extended lead-in times for certain materials, we can mitigate the risk of disruption to projects on the ground.

“But the reality is, we’re looking at a tough winter ahead especially if further waves of Covid impact production further.”